If you’re looking to add an Open Banking provider for payments, you may be doing so because:

-

Card payments take too long to settle. Their lengthy settlement times impact your business by making reconciliation harder.

-

You want to reduce fraud and reduce chargeback risk since cards are vulnerable to misuse.

-

Credit card processing fees are eating into your margins, particularly for your higher-ticket items.

-

You want better visibility of payment transactions after your customers transact with you. This way, you can create faster and more intuitive products and experiences that keep people coming back to you.

-

You’ve spent countless hours designing your user interface and customer journeys and want an equally intuitive way of initiating payments.

Open banking-powered payments can both solve these problems and open the door to exciting new product possibilities. We spoke with Joe Boot – one of our solutions consultants – to learn more about what to look for in an Open Banking solution and how Modulr can help take your business to the next level. We’ll cover:

Modulr helps companies unlock new opportunities through embedded payments. Are you ready to see how we can help you leverage Open Banking to unleash your payment experience? Contact us today to get started.

What to look for in an Open Banking provider

People often think they need a pure play Open Banking provider aka a provider who only supports payment initiation.

The issue with that is that it limits what you can and cannot do with Open Banking. Since the provider only supports you with payment initiation, you won’t have full visibility of funds or be able to automatically reconcile and initiate refunds.

Based on our experience as an Open Banking payments provider and helping customers with their payments, we believe it makes more sense to work with an Electronic Money Institution (EMI) licensed Open Banking provider.

This allows you to take full advantage of what Open Banking offers.

Here’s what to look for in an Open Banking provider and why:

1. Better fund visibility so you know when payments settle

Ideally, you want the payment provider to be able to open up accounts specifically for you and your end-users. Usually, the provider will only be able to do this if they hold the required licence.

The ability to set up unlimited accounts means that you and your end-users have unique account numbers and sort codes, which gives you greater visibility of fund movement and settlement.

With every end-user assigned to their own account, both you and your end-users will not only get better visibility on payment flows but you’ll also have 100% confirmation that funds have been received. Without this, you only have a partial view of if funds were sent, but not if they’ve settled.

2. Make refunds easily to improve your customer experience

An Open Banking payment provider that provides the underlying payment account can also help you issue refunds more easily.

That’s because a unique account, with its own account number, enables you to track and manage funds more easily. You can issue refunds this way more quickly, as you can use the same payment rails the funds originally arrived on. Your customers will thank you for the improved service and you can avoid overloading your support teams in the process.

3. Ability to connect to the banks in the market(s) you want to serve

Open Banking works best when all your customers can use it. Ensure your Open Banking provider has excellent coverage to major banks in your operating area. If they can connect to all the banks your customers work with, it’s even better.

Why choose Modulr as your Open Banking provider

Open Banking is just one of the many services that we, as an embedded payments provider, offer. Here’s what you get when you partner with Modulr:

Automate Open Banking payments without disrupting customer experience

All Open Banking service providers have an API. However, as we’ve already mentioned, most allow you to use the API for payment initiation only. That makes it a lot harder to process refunds, have visibility over funds and you still have to manually reconcile all your payments.

But, with Modulr, you can add Open Banking payments the way you see fit through our single API connection. With our API and automation, you’ll be able to:

-

Set up customer payment flows and triggered events: for example, automatically releasing a product when funds have been received.

-

Receive notifications via webhooks: you’ll be notified when a payment is received, and for example, instruct the API to send all funds at the end of the day once a certain number of funds have been received.

The best way to see what this looks like in practice is with an example. One of our B2B marketplaces onboards their merchants onto our platform and issues each of them a Modulr account.

Throughout the day, our client collects various payments made via Open Banking and segregates them into each merchant’s Modulr account. At the end of each day, our marketplace client automatically sends a single payment to each of their merchant’s external accounts.

This means their merchants no longer need to receive multiple payments, nor do they have to manually reconcile them all. They can also see that these account-to-account payments have settled thanks to Modulr’s API connection and automatic webhook notifications that update them on the funds’ status.

Do you want to learn more about our API and are comfortable with technical docs? Check out our developer and API guides.

Instantly settle payments through Open Banking at minimal cost

Our Open Banking product solves three of the biggest issues you face with cards:

-

Slow settlement of funds.

-

The increased risk of fraud and chargebacks.

-

High processing fees.

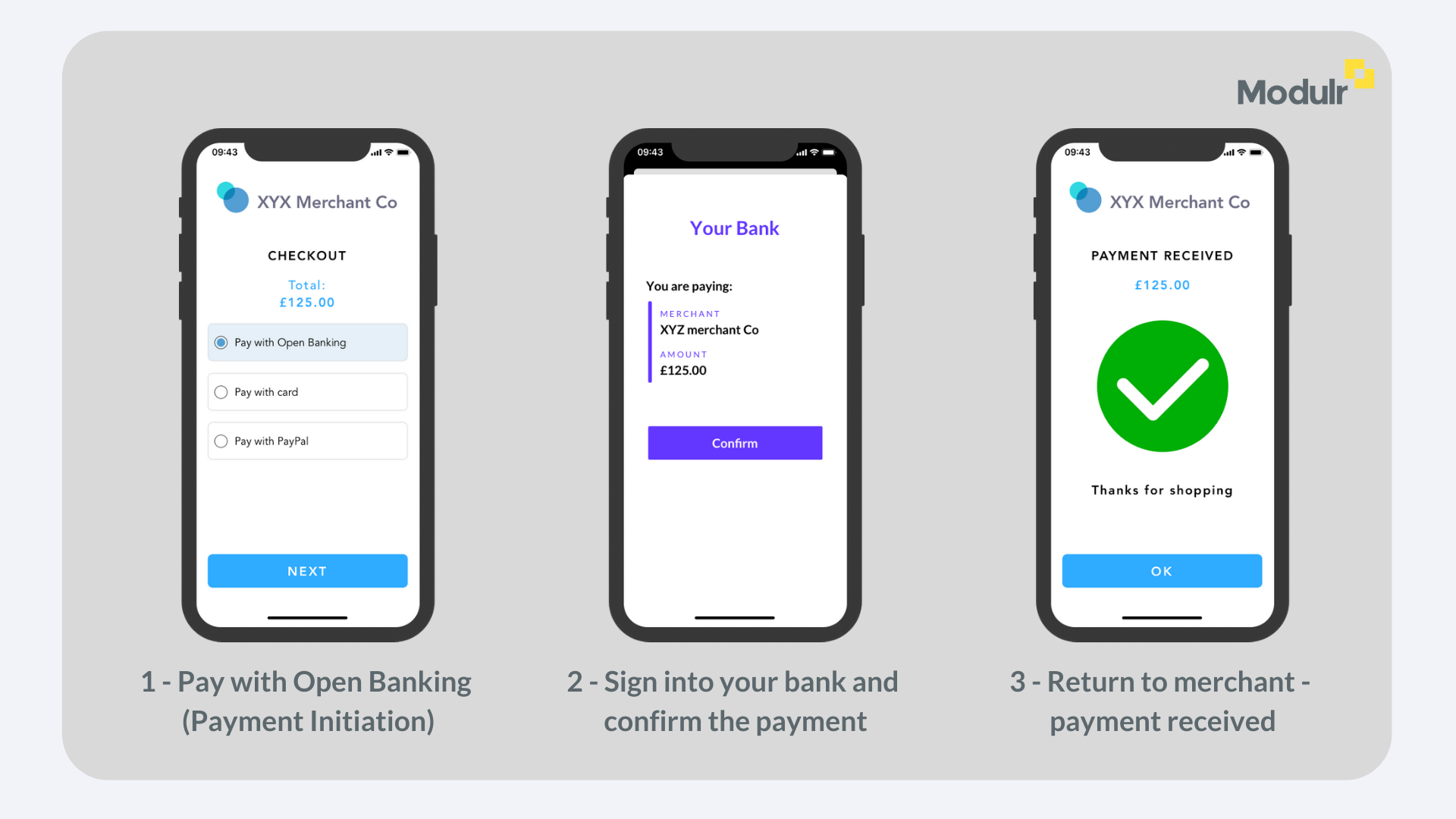

When you initiate an Open Banking payment through Modulr, this is what the process looks like:

-

Modulr’s API fetches the latest list of supported banks and their capabilities. This list is presented to the end-user and they can select their own.

-

When the end-user has selected their bank, you can initiate a new payment using the API. You will need to provide details of the payment, as well as the destination account that will receive it.

-

The end-user will be redirected to their bank using the redirect URL provided and they will authenticate and authorise the payment initiation.

-

Once the end-user has approved the payment initiation, they are redirected back to your application via the redirect URL.

-

You’ll then get a message of the status of the payment initiation and the payment status.

-

When the funds are received into the Modulr account, you’ll get a webhook notification confirming that the payment has been successful.

To learn more about the full process and how to do fixed recurring payments with Open Banking, head to our Developer Docs.

Thanks to our direct connectivity to the Faster Payment network, the transaction will settle from your customer’s bank account into your Modulr electronic money account in a matter of seconds. With our Open Banking solution, you won’t have to wait hours or days like you do with cards to know if payment was successful.

Our Open Banking tools also help you reduce your transaction costs. Like other providers, we charge a flat rate for each payment we initiate. Compared to cards, you could save thousands of pounds in fees per payment.

You can also use our Open Banking product for business models where customers make fixed recurring payments to keep your costs under control. Whatever your model looks like, there’s a good chance we can help boost incremental revenue with our Open Banking solution.

Keep you and your customers safe while minimising risks

Open Banking helps reduce or even eliminate many risks associated with cards, including fraudulent payment and chargebacks. Our Open Banking services go a step further when it comes to protecting you and your customers' data and account information.

We’re regulated by the FCA as an Electronic Money Institution and authorised to provide payment services. We have a 99.99% uptime, so you won’t have to worry about your payment infrastructure going down, whether it’s Open Banking or one of our many payment tools and services.

Connect directly to every major bank in the UK for Open Banking

Some platforms connect to third-party financial institutions to provide their Open Banking services. This can slow your payment and settlement times and put financial data at risk as transaction information passes through multiple parties.

We’re one of the few Open Banking providers who are direct participants in the Faster Payments Service (FPS), which is the clearing system for payment initiation in the UK. In this role, we’re able to connect to our peers in the network, which includes most major banks in the country.

Together with our top-rate platform uptime of 99.99%, you can collect payments instantly 24/7, 365 days a year, thanks to our straight-through processing (no manual intervention needed).

Stay on top of funds in the UK and Europe with our electronic money accounts

We’re a regulated Electronic Money Institution (EMI) in both the UK and Europe through our authorisations with the FCA and De Nederlandsche Bank, respectively. This EMI licence lets you create a unique account number and sort code for each one of your customers (although you will need to separate systems if you want to serve both EU and UK customers).

In turn, you’ll get instant visibility of funds entering or leaving your platform and easily track multi-party payment flows typical of marketplaces and e-commerce platforms. Your finance department can take their reconciliation process from manual to automatic with our EMI accounts, saving them hundreds of person hours.

Issue refunds easily with our API

Open Banking helps minimise the costs and processing time of refunds because returns happen over the same cost-effective and fast payment rails. Yet, processing speed and transaction costs are only part of the refund process.

Before you can reverse a payment, you need to know where the funds in question are. Most Open Banking providers won’t be able to help here because, once they initiate payment and the transaction leaves their system, they no longer have a view on it.

With Modulr, this isn’t a problem. You’ll know exactly where those funds are so you can process the return. Our EMI accounts let you hold on to balances in your system until they’re ready for further use. If you need to process a refund, you’ll be able to do so right away, and directly from the EMI account. This speed has a positive impact on your customers and support teams, as they no longer have to deal with complex or slow repayments.

Access software-powered tools to create a fully embedded payment experience

We’re much more than an Open Banking provider. At Modulr, you’ll be able to embed payments to help transform your operations, multiply your payment use cases, and enhance your customer experience while boosting revenue. We have a full suite of payment products that hundreds of major customers across financial services, accounting and payroll, lending, the travel industry, and more use each day. In addition to Open Banking, you’ll also be able to:

Offer multiple payment options to meet your needs and your customers’ demands

With Modulr, you can access some of the most popular payment mediums, including:

-

Bacs

-

Inbound and outbound direct debits

-

CHAPS

If you have customers in the European Union, you can also make Euro payments with Modulr as we support both instant and regular SEPA credit transfers.

Automate reconciliation to save your finance team and customers’ time

Our EMI accounts let you identify every transaction for each customer. Whenever a payment event occurs, we’ll send you a notification via a webhook, which you can connect to your system as you see fit.

For example, you could use our single API to connect your ERP or accounting software so you can update your ledgers with transaction data automatically.

Embed all your payment solutions through one provider for greater operational efficiency

With Modulr, you’re able to build out your payment flows as you envision, regardless of complexity. Whether your idea of a payment product for your platform entails Direct Debits, Open Banking, Virtual Cards, Account Services or a combination of them, you’ll be able to do so with ease using our API-driven approach.

Get the support you need to build the Open Banking payment product you envision

Your Open Banking journey with Modulr starts from pre-launch. As soon as you become a Modulr customer, we’ll assign a small, dedicated team of experts to help you get started. This squad consists of individuals with years of experience in product development, IT, compliance and business strategy.

Together, they’ll work with you to find the optimal way to add Open Banking payments to your platform. As soon as you’re ready to build, our experts will assist you with your technical questions so you can quickly develop and deploy your new payment offerings.

After you launch your new Modulr-powered Open Banking product, we’ll be there to support you should you have any questions. As you grow, you’ll be able to do so with the continued assistance of your team of experts. Whenever you have a new idea or want to iterate on an existing payment setup, just reach out. Our squad is happy to brainstorm with you to find a solution.

Try Modulr: The Open Banking provider that unlocks payment opportunities

By leveraging Modulr’s Open Banking services with our other embedded payment products, you can create the type of customer experiences that keep people coming back while simultaneously boosting your bottom line.

Contact us today to see how we can help you transform your payment experience.