Introduction

While most accountancy practices want to provide a comprehensive solution to their clients, many avoid offering payment services due to the inefficiencies of traditional payment processes.

Others go down the Bacs Approved Bureau (BAB) route, but this requires significant resource and investment and still doesn’t make payments any faster or simpler - relying instead on a payment method that originates in the 1960s.

Time has moved on, but Bacs hasn’t.

Many don’t realise there’s a more modern way to make payments, but there is. Accountancy practices can now offer payment processing via Modulr’s direct access to the Faster Payments Scheme, and all within their preferred accountancy software. So, instead of three-day clearing cycles, strict cut off times and slow processing, they benefit from faster payments 24/7, while unlocking increased efficiency, new revenue streams and the benefits of a stickier, more comprehensive offering.

It’s time to reimagine payments, with Modulr and your accounting software of choice.

How accountancy practices traditionally approach payments

When it comes to payments, accountancy practices fall into three categories.

- Those that don’t offer payments – clients must manually make payments themselves

The majority of accountancy practices don’t currently offer payment services, and for valid reasons. They’re seen as low-value, time-consuming, error-prone and a logistical nightmare. There’s also risk and regulations to take on which teams may have no prior experience with.

Payments are therefore left to businesses, which have to process everything manually through their own bank account when they want to be focusing on growth. This type of task is what many businesses are hoping to avoid when they sign up to accountancy services. - Those that become a Bacs bureau

Some accountancy practices offer payment services to their clients by becoming a Bacs bureau, enabling them to submit Bacs payments on their clients’ behalf. This takes the payment onus off clients, but getting set up is a long and costly process for the accountancy practice, with continuous requirements to be upheld, as we explain later. - Those who are somewhere in between – accessing client bank accounts or clients sending money to practice bank account

For practices that want to offer a complete service but don’t want to go through the lengthy process of becoming a Bacs bureau, they opt for a halfway house. This involves either logging on to the clients’ banking portals or asking clients to transfer funds to the practice’s bank account, so payments can be made on their behalf.

Both come with risks and disadvantages. Logging on to online banking portals requires a high amount of trust from the client and doesn’t feel like the appropriate action for modern business support. However, requesting funds from clients exposes the practice to potential delay and reconciliation headaches.

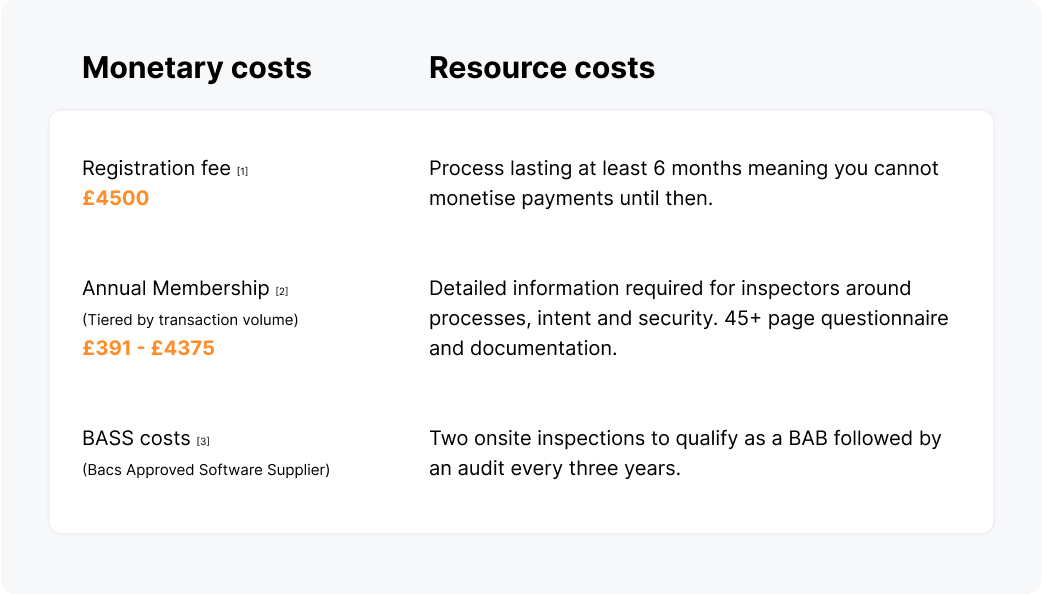

What it costs to become a Bacs Approved Bureau

There’s a clear appeal in becoming a Bacs Approved Bureau (BAB). Handling payments on behalf of clients makes for a stickier, slicker offering and can add a new revenue stream for the practice if it’s a charged-for service.

But becoming a BAB is no walk in the park. Your practice needs to pay a substantial upfront and ongoing cost, as well as time and resource commitments that shouldn’t be ignored.

The next step: Obtaining the elusive SUN

Becoming a BAB is just the first step to offering full payment services.

For clients that want to make or receive Direct Debit or Direct Credit transfers using Bacs, they’ll still need a Service User Number (SUN). This six-digit number, held and managed by Bacs, is used to identify the business and create records of each transaction.

As a BAB, you can issue your clients with a SUN and manage it for them, but there’s work associated with doing so:

- Each client has to apply for a SUN and it can take months to be approved.

- SUNs are only issued to businesses who are sponsored by major UK banks.

- Different banks have different processes, which means the possibility of getting a SUN and the time it takes is not consistent.

- If the client hasn’t been established for more than 3 years or has less than £1million in turnover, they’re unlikely to be given a SUN.

- It will cost each client £200 to apply for a SUN.

The hidden, and not so hidden, costs of Bacs errors

Your practice may now be a BAB and you’ve sorted out SUNs for your clients, but the hard work isn’t over - the world of Bacs is fraught with manual process and potential error.

Matching a payment to the wrong bank details, the recipient providing incorrect details, a payment being duplicated on the file, a payment being omitted from the file, a downloaded file being sent to the wrong client are just some of the points of possible failure.

And these failures cost you, with fees varying between banks:

- Bacs file rejected – Up to £100

- Amending a Bacs file – Up to £300

- Reversing a Bacs file – Up to £2,000

- Emergency CHAPS payment - Approximately £25-£30 per transaction

And then there are the hidden costs - harder to calculate, but just as impactful.

- Loss of customers due to costly mistakes

- Reputational damage making it harder to gain new clients

- Staff time spent calling banking relationship managers and chasing payments

It is up to you whether you pass on these charges to your clients. The causes of the errors may be completely out of your control. However, an approach which cuts down errors, and keeps resolving any errors affordable, is obviously better for everyone.

There must be another way

For too long, accountancy practices have been let down by payment services. They’ve had to run a costly gauntlet between becoming a BAB or taking a more rudimental approach, with its data sensitivities and high level of risk.

Both approaches invite mistakes and errors which then cost the practice even more – it’s no wonder the majority don’t go anywhere near payments.

Finally, there’s a more modern way.

Accountancy practices can now leverage Modulr’s direct access to the UK’s Faster Payments System through their accountancy software, regardless of which software they use, enabling them to make payments in real-time on their clients’ behalf.

What hurdles need to be jumped to get set up? None at all. Modulr’s payment technology is embedded in all major UK accounting software – Xero, Sage, Bright Pay and IRIS. You can begin processing real-time payments within hours.

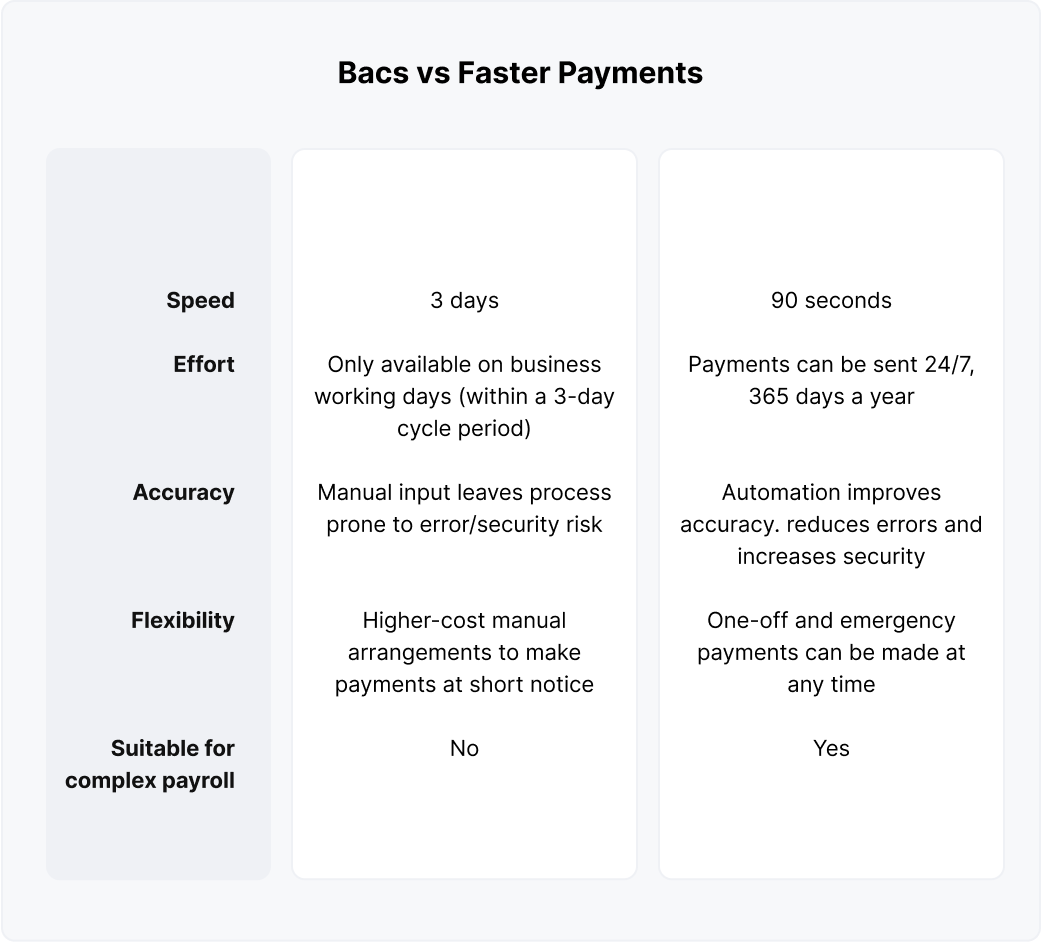

So, how does an embedded Faster Payments option compare to the traditional approach.

Faster Payments vs Bacs

Using Faster Payments over Bacs isn’t just about speed. An embedded approach linked to Faster Payments makes payment processing simpler, smarter and more flexible for all types of payroll.

Why Faster Payments beats no payments

If you’re still unsure on whether your accountancy practice needs payments, there are gains to be had you may not have realised. Alongside that, it’s important to note that more and more practices are adopting this approach. Ignoring payments risks your practice falling asleep at the wheel.

The benefits of offering payments

- Be the one-stop-shop your clients are crying out for: Businesses want to concentrate on running the day-to-day. Taking payments off their plate makes your practice a far more attractive proposition.

- A substantial new revenue stream: Payments are a chargeable service. As more and more of your clients opt for payments, your revenue can rise accordingly.

- Be prepared for the future: Not acting now puts your practice at a competitive disadvantage. Offering payment services (and Faster Payments specifically) keeps you on top of changing client expectations and increases the likelihood you’ll gain customers from competitors, while holding on to your own.

- It’s easier than you think: No licences, no inspections, no renewal costs, no manual file uploads, no high setup costs. Offering Faster Payments through Modulr is a whole different ball game.

Why Modulr?

Modulr has created a payment function specifically for accountancy practices via the most trusted accounting software in the UK today.

Who we are

- One of the only non-banks with direct access to the Faster Payments System

- Trusted by hundreds of major customers across the Accounting and Payroll space

- Client funds secured with the Bank of England

- Over $1billion worth of payments processed

- Integrated with Xero, Sage, BrightPay and IRIS.

- Operating since 2016

- Listed as one of Europe’s fastest growing companies by the Financial Times

- Regulated by the Financial Conduct Authority

What we give you

- Real-time payments

- Instant, automated reconciliation

- Ability for your clients to be as involved as they wish

- Consolidation of multiple payments to a single beneficiary, reducing transaction fees

What our customers have said

Switching its Bacs Approved Bureau status for Modulr’s embedded payments has reduced team workload by 80% at Martin Aitken and Co, while giving the practice a new revenue stream and unlocking a faster payroll service for its customers.

“Using Modulr’s integration with BrightPay has reduced the time we spend on payments by about 80%, so many of the steps are done for us and all we need to do is click a button. The impact it’s had has been massive... And, when you consider the £4,500 BACs registration fee, the Bacs software costs and all the time spent on manual processes, it’s also far more cost-effective.”

Jacqui May, Head of Payroll, Martin Aitken and Co.

Don't delay, switch to Modulr today

An accountancy practice that can offer payment services will always be more valuable than one that can’t. Now, it’s never been easier to make that happen.

Becoming a BAB will require a huge amount of work for a result that can create more problems than it solves. By using Modulr’s embedded payments through your preferred accounting or payroll software however takes the payments onus away from your customers, gives them faster payment possibilities and drastically reduces your manual processing.

So how does it work? Read our next guide to see what our payment technology looks like.