Frequently Asked Questions

Frequently Asked Questions

Modulr provides a new type of payment account. Built for businesses that need a faster, easier and more reliable way to move money.

Contact →Take the payroll and payment workload away from your clients and benefit from time-saving automation, faster processes and instant payments.

Enabling payroll bureau, recruitment agency or umbrella company to deliver a fast, secure and easy way to pay employees

Automate your business payroll and supplier payments. Remove manual processes, save time and eliminate costly errors.

Modulr unlocks incremental revenue, operational efficiencies and way smoother customer experiences.

Modulr →Modulr provides a new type of payment account. Built for businesses that need a faster, easier and more reliable way to move money.

Contact →Modulr unlocks incremental revenue, operational efficiencies and way smoother customer experiences.

Modulr →Frequently Asked Questions

Modulr is the payments tool for accountants, payroll bureaus and financial controllers which saves them time and alleviates the payments admin burden. We love payments and we're working together with our Pathfinder community to make payments technology work better for accountants.

We’re also an award-winning Embedded payments platform - built for businesses that need faster, easier and more reliable ways to move money. Modulr is transforming the way companies - and the accountants who support them - do business, by improving payments functionality and enabling them to leverage new technologies.

Modulr (Modulr FS Ltd) is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (FRN: 900573). This means we can issue e-money accounts with account numbers and sort codes. As a direct participant of the Faster Payments and Bacs schemes, we hold and settle funds at the Bank of England, providing reliability and security for our users.

Save Time and Maximise Efficiency: Take the payment workload away from your clients and benefit from time-saving automation, faster processes and instant payments.

Eliminate complex and error-prone processing: We replace manual reconciliation and date entry with automated and intelligent payment workflows.

Faster Payments: All payments sent from Modulr use the Faster Payment service, meaning they will arrive instantly in your recipients’ bank account.

Premium client service: Deliver a seamless and smarter customer service on time, every time.

Data Consistency: Keep data consistent across payments, payroll and accounts for easy reconciliation and HMRC submissions.

Secure and Compliant Network: Process payments through a highly secure and compliant network. Modulr is authorised and regulated by the FCA.

Fill in your contact details and our Sales team will be in touch to walk you through the options available. You can then return to the main page to make your selection.

Faster Payments Service (FPS) is the payments scheme owned and operated by leading retail payments authority Pay.UK, the company also responsible for Bacs payments and cheques, as well as related services such as mobile app Paym, the Current Account Switch Service, and many others. Faster Payments enables mobile, internet, telephone, and standing order payments to move quickly and securely between UK bank accounts, 24 hours a day and often received within seconds.

Bacs

• File-based export/upload. Manual process across multiple systems

• Payments settled in 3 days. Funds tied up throughout process

• Only available on business working days (within 3-day cycle period)

• Requires alternative and higher-cost arrangements to make payments at short notice

• Failed payments require manual tracing

• Manual input leaves process prone to error/security risk

• Unable to provide for gig economy/emerging payment structures

Faster Payments

• No file upload

• Payments settled within 90 seconds

• Payments can be sent 24/7, all year round

• One-off and emergency payments can be made at any time

• Bank details checked at setup and anomalies automatically highlighted

• Automation improves accuracy, reduces errors and increases security

• Serves gig economy/emerging payment structures with BAU process

For more information regarding different payment schemes, please check this information.

SEPA Instant Credit Transfer (SCT Inst) is an electronic payment made from one bank account to another across the SEPA region within 10 seconds.

SEPA Instant Credit Transfer (SCT Inst) is the default primary payment method for EURO payments. Your e-money account will also be enabled to receive SCT Inst payments.

SCT Inst allows payments up to 100,000 Euros to be processed within 10 seconds and is available 24/7/365. To process a SCT Inst, the payment must meet the following criteria:

The payment must have a maximum value of 100,000 Euros.

The payee’s destination account must be SCT Inst enabled.

SCT Inst can be paid into the 27 member states of the European Union (EU), 3 additional countries of the European Economic Area (EEA): Iceland, Liechtenstein and Norway and the 6 non-EEA countries: Andorra, Monaco, San Marion, Switzerland, United Kingdom, Vatican City State.

If the payment is unable to be processed as SCT Inst, Modulr will automatically process the payment as SEPA Credit Transfer (SCT).

NOTE: As relatively few banks in Ireland are SCT Inst enabled, we recommend to achieve same day settlement, payments should be created and approved before 14:00 (GMT/UTC).

To achieve same day settlement, payments should be created and approved before 14:00 (GMT/UTC).

The maximum transaction amount of an SCT payment is 999,999,999.99 Euros.

For more information regarding different payment schemes, please check here for more information..

For UK payments: We have access to the UK Faster Payments Network, meaning that payments can be processed and in the recipient’s account within 90 seconds, 24/7. You can of course post-date payments and prepare payroll in advance, but you no longer need to submit payments the day before to pay employees, or even suppliers or your PAYE Tax, on time.

For EURO payments: We use SEPA Instant Credit Transfer (SCT Inst), meaning payment can be made from one back account to another across the SEPA region within 10 seconds. If SCT Inst is not enable by the recipient bank, payments will default to standard SEPA Credit Transfer. Customers who wish to achieve same day settlement should continue to observe the 14.00 (GMT/UTC) SEPA Credit Transfer cut off time.

You get access to the Modulr portal when you've set up your Modulr account. However, if you'd like to see the Modulr portal sooner, you can create a Sandbox account here where you'll be able to get a feel for the Modulr portal. You’ll be able to play around with the platform as you please since this will not cause any damage whatsoever. For Employers, we refer to it as Modulr Customer Portal since you will be managing and making your own payment flows without granting access to an external Accountant.

We have set limits on payment activity. However, this can be amended should the need to arise. Please contact the support team below. The limits are: 500 payments a day, 2000 a week and up to £100k per payment, £450k in total payments a day.

The Modulr account can be topped up via a regular bank transfer from business account, from directly inside the software using the get funds button or via standing order (and chaps too which is subject to a £6.50 admin cost by Modulr, plus the cost the banks charge). We don’t currently have a direct bank feed into your business account.

Your company name.

Modulr is authorised and regulated by the FCA as an Electronic Money Institution (FRN: 900573). This means we can issue e-money accounts with account numbers and sort codes. As a direct participant of the Faster Payments and Bacs schemes, we hold and settle funds at the Bank of England, providing reliability and security for our users. As an authorised and regulated Electronic Money Institution we’re required to keep 100% of our customers’ money safeguarded at the Bank of England and totally separated from our own funds. This means that e-money held in Modulr accounts is protected from any risk associated with our insolvency excluding costs deducted by the insolvency administrator, as laid out by the FCA. Our platform is built and operated to the highest levels of security, utilising web application firewalls, DDoS protection, threat detection, certificate management, penetration testing and two-factor authentication as well as being PCI compliant. We take a security first approach to everything – protecting your data, your business and your customers.

Modulr is authorised and regulated by the Central Bank of Ireland as an Electronic Money Institution (Reference Number C191242). This means we can issue e-money accounts with IBANs. As a participant of the SEPA schemes, we hold and settle funds at the Bank of Lithuania, providing reliability and security for our users. As an authorised and regulated Electronic Money Institution we’re required to keep 100% of our customers’ money safeguarded at the Bank of Lithuania and totally separated from our own funds. This means that e-money held in Modulr accounts is protected from any risk associated with our insolvency excluding costs deducted by the insolvency administrator, as laid out by the Central Bank of Ireland. Our platform is built and operated to the highest levels of security, utilising web application firewalls, DDoS protection, threat detection, certificate management, penetration testing and two-factor authentication as well as being PCI compliant. We take a security first approach to everything – protecting your data, your business and your customers.

Modulr uses Authy – a two-factor authentication app that provides an additional layer of security - to securely authenticate the user to access Modulr portal.

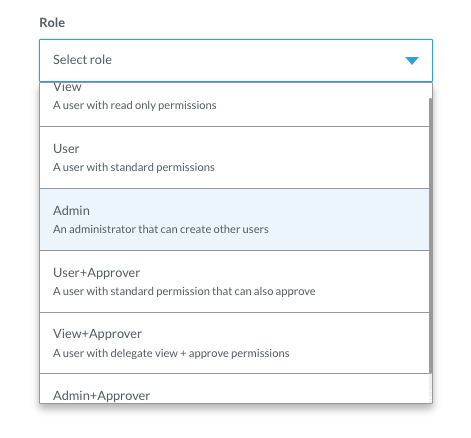

Yes. We have a range of permission levels and a dual authentication app which is required when accessing the Modulr account, and approving payments etc.

Yes. Anyone responsible for uploading payment files or approving payments will need to be set up on the Modulr portal to carry out these tasks.

You are able to set up new users directly within the portal.

Yes. If there are not enough funds in the Modulr account the payments will be held as Pending Payments until sufficient funds are added to the account to cover the payments.

You can however, approve the payments before funding Modulr. Just ensure the funds have been added in time for the scheduled date.

The payments will be held as Pending Payments until sufficient funds are added to the account to cover the payments.

As standard we include 5 inbound payments “top ups” per month. If further inbound “top ups” are required, these are charged at the standard transaction fee rate. Find out more information here.

All successful transactions can be reviewed in the Reports screen. Reports can be exported in .csv format and then, you can easily filter transactions. Any scheduled or failed payments can be viewed within the Pending Payments screen.

An Accountant will be able to manage multiple clients' accounts by having access to a Payments Dashboard which makes is easier to manage payroll, payment flows, and accounts payables in one place.

For any issues encountered on Modulr portal or in the sign up/authentication process, please contact us at support@modulrfinance.com.

The setup process will vary depending on your service model and whether you will be making payments on behalf of your clients.

You will be sent an email with a link to the registration form after you make your package selection with the help of our Sales team.

You will need to enter some basic information regarding your Accountancy Practice/Bureau- we require this for compliance purposes. Requested documents can be submitted to Modulr electronically. You only need to fill this out once (then you can sign up as many future clients as you want).

The application will be reviewed and accepted by Modulr subject to successfully passing compliance checks. Updates regarding your application will be sent to the email address provided in step 1.

Once Modulr has completed the setup of your Modulr portal, you will receive step by step instructions on setting up your access and on inviting your clients, and a “Welcome” email directing you to sign into the Modulr portal.

Modulr will work directly with you to support in onboarding your clients. You will need to send your Delegate reference number to clients that are signing up. Once a client registers and links their Modulr account, you will receive a confirmation email.

You can then view and manage clients’ payment workflows in the Modulr portal.

For additional information, please contact your Practice Enablement. Alternatively, please email enablement@modulrfinance.com

You can get set up easily by visiting this link. Simply select ‘for your business’ and your software provider then choose pricing package then off you go!

What happens next:

After you have selected your package and entered your contact details, you will be sent an email with a link to continue your application process.

Subject to information being provided correctly, most customers are approved within 2 business days. We’ll contact clients directly should we require any further information. Modulr has a dedicated support desk to assist.

For further detail please email support@modulrfinance.com

Modulr is authorised and regulated by the Financial Conduct Authority and therefore is required to conduct customer due diligence on everyone provides financial services. You may be asked to provide documents to support these checks. To make this easier, you can send all of these documents electronically. The faster we receive this information, the faster you can start benefiting from Modulr’s integration with your preferred payroll or accounting software platform.

‘KYB’ stands for ‘Know your Business’, therefore you will be asked to provide information to identify your business or your client's business. This will include information on Company Directors and Ultimate Beneficial Owners (UBOs).

Yes, you can. However this does depend on your client service model.

To provide this service without your clients requiring a Modulr account you must be managing funds on behalf of your client. This means you will be making the payments and payments will appear from your business name on Payee statements.

If you/your clients would like to manage their own funds they will be required to onboard to the Modulr portal.

Once you are onboarded on the platform, you will receive two emails, one to activate your Modulr Payments Dashboard access and one with instructions to invite your clients. Additionally, there is plenty of support available on our dedicated Resource Hub, such as guides to products, guides to onboarding your clients, and marketing resources.

Contact your Practice Enablement for more information. Alternatively, please email enablement@modulrfinance.com

You will need to provide your customers with your Delegate reference number for them to be able to link their Modulr account to your Payments Dashboard. The Delegate reference number can be found by selecting your Accountant’s business name (in the top right of the Customer Portal, next to your username) which displays your Delegate information.

Onboarding steps for your clients:

You will need to invite clients to register to use the Modulr portal. They will then need to complete the application form with basic information regarding their business; we require this for compliance purposes. Requested documents can be submitted to Modulr electronically.

Modulr will review the client application. We’ll be in touch directly with the clients if any further information is required.

Once their account is set up, they will receive a “Welcome” email, and your client will need to create a password and sign in to the portal.

To link their Modulr account to a Delegate, your client has to navigate to Users → Delegates page and enter your (the accountant’s) Delegate reference number plus complete the other details in the form, and confirm they are linking to the correct accountant (Delegate).

You will be notified that your client has signed up successfully, and you can start managing payments through the Modulr portal on their behalf.

Yes, you'll be automatically upgraded to use the Modulr portal to manage your own payroll, while having access from within the same portal to see the Payments Dashboard (See section below on what is the Payments Dashboard).

Yes, you'll be able to integrate Modulr with any of the supported payroll and accounting software platforms which you can check here.

You and your clients can easily view payment status directly from within the Modulr portal. You can then manage all your clients' payment flows within Payments Dashboard.

The Pending Payments and Approvals screens make it easy to check the status of all your payments in real-time. Successful transactions can be viewed in real time in your Transactions list in the account view.

For further detail please email enablement@modulrfinance.com

Please contact our Support Team Monday- Friday 8-6pm on:

T: +44 (0)303 313 0060

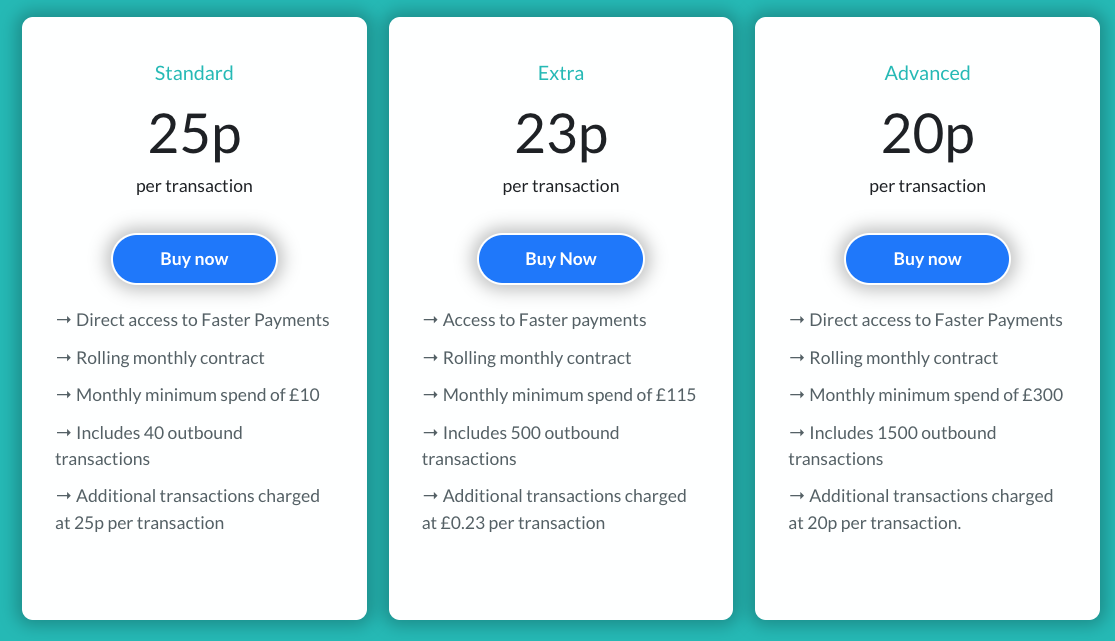

We do not charge a set up or implementation fee and you can select which package best suits your needs. You can always upgrade or downgrade your package. Find out more here

An Admin User is the person responsible with the administration of the Modulr portal. You can easily create more Users directly in the Modulr portal.

Yes, you can delegate the access to an Accountant by linking your Modulr account to their Modulr portal using their unique Delegate reference number. You will also be able to choose the level of access you grant to the Accountant. For further information on how to link your Modulr account, please contact us at support@modulrfinance.com.

You can easily view payment status directly from within the Modulr portal. The Pending Payments and Approvals screens make it easy to check the status of all your payments in real-time. Successful transactions can be viewed in real time in your Transactions list in the account view.

If you choose to delegate access to an external Accountant, he/she will manage payment workflows on your behalf, but you will still be able to approve and check payments status at any time by signing up to your Modulr account.

For further detail please email support@modulrfinance.com

Please contact our Support Team Monday- Friday 8-6pm on:

T: +44 (0)303 313 0060

If you're an Accountant/Bureau and you manage payment flows on behalf of your clients, please contact our Sales Team to provide you with more information on how and when you will be charged.

If you're using Modulr for your business visit this link. Simply select ‘for your business’ and your software provider to find the packages available.

Modulr supports payments card and direct debit billing for UK customers and payment card only for customers registered in Ireland. You will need to fill in your payment details when choosing your preferred package.

You will be charged monthly.

You'll receive your invoice via email which will be sent on the date that you're due to be billed. This will include your subscription fee for that month and any over usage of transactions undertaken in the previous month (if any).

When you subscribe to one of the pricing packages, you will be paying a prorated subscription fee. The next charge will consist of the monthly subscription fee plus the over usage from the previous month (paid in arrears).

To upgrade your subscription, please contact support@modulrfinance.com.

If you need to change your payment information or your billing address, please contact support@modulrfinance.com.

If your card is about to expire or if your payment has failed for any other reason, we'll notify you via email and you'll receive a secured link where you can update your card details.

You'll receive your invoice via email which will be sent on the date that you're due to be billed. This will include your subscription fee for that month and any over usage of transactions undertaken in the previous month (if any).

If you cancel your account before the 25th of the month, your account will be cancelled automatically at the end of the month and you’ll be charged the over usage for that month. If you cancel on or after the 25th of the month, your account will remain live for the following month, and you will be charged your subscription fee, plus any over usage at the end of that month. Please note, there are no partial refunds when subscription is cancelled early.

To cancel your subscription, please contact support@modulrfinance.com. You must be the account owner and the email has to come from the one setup in Modulr’s portal. Please reference in your email your full name and your preferred mobile number to be contacted on.

The Modulr subscription is set up on an invoice basis and is separate to when you run payroll. You'll receive your invoice via email which will be sent on the date that you're due to be billed. This will include your subscription fee for that month and any over usage of transactions undertaken in the previous month (if any).

No. While payments are uploaded to the Modulr portal using the Bacs18 file format, your payments will be processed in just 90 seconds via Faster Payments.

Removes the burden and cost associated with setting up and using Bacs process

Eliminate risk of late or missed payments, with payments received in 90 secs

Eliminate need to use high-cost emergency payments e.g. CHAPS

Create a full audit trail making errors easy to spot and rectify

Bank details are automatically checked and anomalies highlighted at set-up (rather than post payment with Bacs) resulting in fewer payment failures

No need to tie funds into lengthy Bacs cycles, creating real-time cashflow management and greater insight into business performance

Added security and service levels is provided by the payment approval process

Run payroll as normal within your accounting software - do what you normally do! Prepare and export Bacs18 file.

Log in to your Modulr portal and upload payment file and confirm payment.

Employers are sent a notification that they have payments awaiting approval. Once they log into the Modulr portal, they can authorise the payment via secure two factor authentication. Make sure the Modulr account is funded before payments are executed to employees.

You will be able to easily see payments updated within the Modulr portal, meaning you'll know exactly what's paid and pending.

BrightPay has partnered with Modulr to allow accountants and their clients to quickly and easily instruct payroll payments from within BrightPay. Modulr is an award-winning Payments as a Service API platform – built for businesses that need faster, easier and more reliable ways to move money. Accountants or Employers who wish to use the Modulr service must sign up for a Modulr Payment Account separately and pay any associated fees to Modulr.

It’s a payments account – with sort code and account numbers - giving you a fast, secure and easy way to make payments from Brightpay. Payroll payments can now be initiated within BrightPay without the need for payment files, allowing for a flexible, secure and fast way for accountants/ bureaus and employers to work together to make and approve payments. It’s an API connection between Modulr’s payments and account infrastructure and BrightPay’s payroll software which syncs payroll calculations to payment entries. From a single and secure portal, employers/accountants/bureaus can view pending and paid payments and approve outstanding payments.

The Modulr BrightPay integration enables accountants to provide their clients with seamless payroll workflows. The single and secure online portal allows accountants to make payroll payments at the same time as running client payroll, saving accountants precious time, removing manual processes, and eliminating costly errors.

For more information related to BrightPay integration with Modulr, please visit Paying Employees using Modulr and Paying Subcontractors using Modulr.

IRIS currently partners with Modulr (Modulr FS Ltd) to provide a File Upload capability for their customers.

We will be further strengthening our partnership throughout 2021 to provide a more seamless experience for IRIS customers. This will fully integrate the Modulr payments platform with IRIS and will remove the need to manually upload a file to the Modulr portal.

Yes, you'll be automatically upgraded to the fully integrated capability to using File Upload functionality on the Modulr portal.

If your clients will be directly set up on the Modulr portal, you will need to provide a file per client.

Xero has partnered with Modulr to allow accountants and SMEs to make bill payments through Modulr to save time, remove manual processes and eliminate costly errors when you pay bills in Xero.

If you are already a Modulr customer you simply have to sign in to the Modulr portal and navigate to ‘Connections’ in the side menu to get started. If you are a Modulr accountant or bureau: invite your client’s admin user to connect to Xero in the Modulr Portal using the ‘Connections’ option in the side menu.

When you send a Bill payment from to Modulr, Modulr will perform a series of validations when a payment request arrives from Xero. If some of the criteria are not met, the payment will be reversed. There are a few different reasons that might prevent a payment from being displayed in Modulr. If your payment is not showing:

In order for Modulr to create statement lines in Xero, you will need to sync your E-money account during connection. Once the Modulr account is synced, it will be created an account in Xero. All transactions that happen in Modulr will be automatically reflected as statement lines in Xero.

Similarly, in order to create a payment for a bill you have to sync your E-money account so it can be used as Source Account.

If you have access to the Modulr Portal and have an Admin role, you should see ‘Connections’ at the bottom of the side menu. If you still cannot see the connect, please email Modulr customer support.

When you start to connect as showed before, you will be redirected to Xero. If you have trouble logging in to Xero, contact Xero customer support

If you have any other enquiries regarding connection, please email us on: support@modulrfinance.com

If you have issues creating a bill to pay in Xero, please contact Xero Customer Support

If you are unsure about how to add a Payment to your Bill or about creating a batch payment for multiple bills using your Modulr e-money account, please email us on: support@modulrfinance.com

Modulr portal is supported on Mac and Windows, but preferred browser is Chrome on both. We also support Safari, Mozilla Firefox, and Microsoft Edge. Internet Explorer is not supported.

Please note, BrightPay integration is supported only on Windows at the moment.

Join our exclusive community and help us create our new payments solutions. You’ll be able to test new features, tell us what you like and what we can improve.

Have a question? Contact us to speak to a Modulr expert today.