With our pricing options,

there's a plan to suit you.

Bronze

£16.25 per month-

Up to: 25 outbound transactions

-

Payments in 90 Seconds with direct access to Faster Payments

-

Includes Payroll and Supplier Payments

-

Onboarding and Technical support

-

Mobile App for Approvals

- Rolling Monthly Commitment

Silver

£67.20 per month-

Up to: 200 outbound transactions

-

Payments in 90 Seconds with direct access to Faster Payments

-

Includes Payroll and Supplier Payments

-

Onboarding and Technical support

-

Mobile App for Approvals

- Rolling Monthly Commitment

Gold

£125.00 per month-

Up to: 400 outbound transactions

-

Payments in 90 Seconds with direct access to Faster Payments

-

Includes Payroll and Supplier Payments

-

Onboarding and Technical support

-

Mobile App for Approvals

- Rolling Monthly Commitment

Platinum

£300.00 per month-

Up to: 1000 outbound transactions

-

Payments in 90 Seconds with direct access to Faster Payments

-

Includes Payroll and Supplier Payments

-

Onboarding and Technical support

-

Mobile App for Approvals

- Rolling Monthly Commitment

Unfortunately we do not accept applications from Charities that are not registered with Companies House

as a Limited Company or from Societies.

BrightPay integration is currently only supported on Windows.

How it works

4 steps to perfectly synced payroll and payments

1. Run Payroll as normal with BrightPay

2. Select ‘Pay by Modulr’ in BrightPay

3. Approve pending payments in your Modulr portal

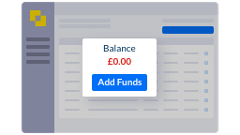

4. Top up your Modulr account and pay your employees in minutes

Eliminate the manual workload associated with paying employees.

“We are delighted to be able to offer this facility to our customers. Having spent a large part of my career as a practising accountant (with a payroll bureau service), I know just how time consuming the process of paying employees can be and still is to this very day. This changes everything!”