Top 5 ways to transform your AP function for 2026

Start the year with greater efficiency, control and confidence.

Accounts Payable teams are under pressure to do more - without adding complexity. More invoices. Tighter cash flow. Greater fraud risk. And growing expectations around speed, accuracy and control.

Yet many AP functions are still held back by manual processes. According to the APA’s 2025 Industry Benchmarking Report, only 15.7% of organisations have achieved high levels of AP automation. That gap presents a clear opportunity: to automate how money moves, strengthen controls and build AP operations that scale.

As new payment practice reporting requirements approach in 2026 such as the late payment legislation, leading finance teams are rethinking payables end to end. They’re moving away from fragmented tools and manual banking, and towards payments automation platforms built for scale.

Here are five practical ways to start 2026 with an AP function that’s faster, more accurate and ready to grow.

Jump to:

- Map your process - and involve the people who run it

- Reduce errors - and start the year without avoidable issues

- Automate where it counts

- Tighten controls and reduce your risk

- Use instant payments to improve cash flow visibility

Map your process - and involve the people who run it

New year, new process? Let’s start with the basics. Mapping your AP process end to end - from invoice capture and approvals through to payment and reconciliation - reveals where effort, risk and delays really sit.

The most effective AP transformations start with the people closest to the process. At key industry events last year, finance leaders consistently highlighted the same lesson: successful AP transformation starts with involving your teams early. The people handling invoices, managing exceptions and speaking to suppliers every day often have the clearest view of where delays, risks and inefficiencies sit.

When auditing your systems, take time to speak to your AP teams about their day-to-day reality. Where do they spend the most time? What workarounds exist? Where does information get lost?

Common challenges include unclear approval paths, inconsistent data capture and fragmented handovers between teams. Fixing these fundamentals creates a stable foundation for automation and scale.

Our customers tell us that this approach not only uncovers opportunities for improvement but also drives far stronger adoption when new tools or processes are introduced.

Getting the basics right helps you achieve:

- Faster approvals and fewer delays caused by missing information

- Easier onboarding for new team members

- Clearer visibility over payment timing and cash flow

Involving your team early does more than surface insight. It creates buy-in. When people understand why processes are changing - and have had a hand in shaping them - new ways of working and new tools are adopted faster and used properly.

Start 2026 with clarity - because you can’t improve what you can’t see.

Reduce errors - and start the year without avoidable issues

Few things undermine confidence faster than an invoicing error early in the year. A duplicated payment, incorrect amount or missing supplier detail can quickly turn into hours of investigation, strained supplier relationships and unnecessary pressure on AP teams.

Manual processes are often the root cause. Re-keying data, managing approvals across systems and chasing invoice details by email all increase the risk of mistakes - and slow everything down.

Reducing manual work allows AP teams to:

- Cut out back-and-forth communication with suppliers

- Prevent duplicate or incorrect payments

- Build stronger, more reliable supplier relationships

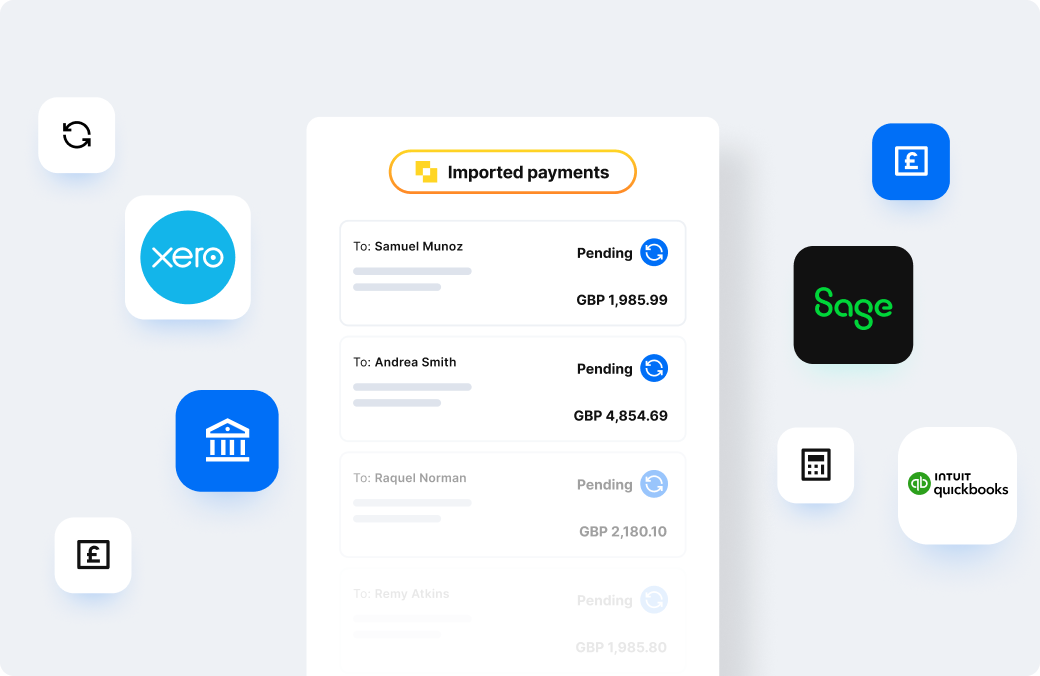

Encouraging suppliers to submit invoices via accounting software with dedicated supplier portals - such as Xero, Sage or BrightPay - helps capture accurate data upfront and spot issues sooner.

Modulr integrates directly with leading accounting platforms, removing friction between invoice approval and payment execution and helping teams move faster with confidence.

2026 should begin with momentum, not manual clean-ups.

Find out how Modulr works with your accounting software →

Automate where it counts

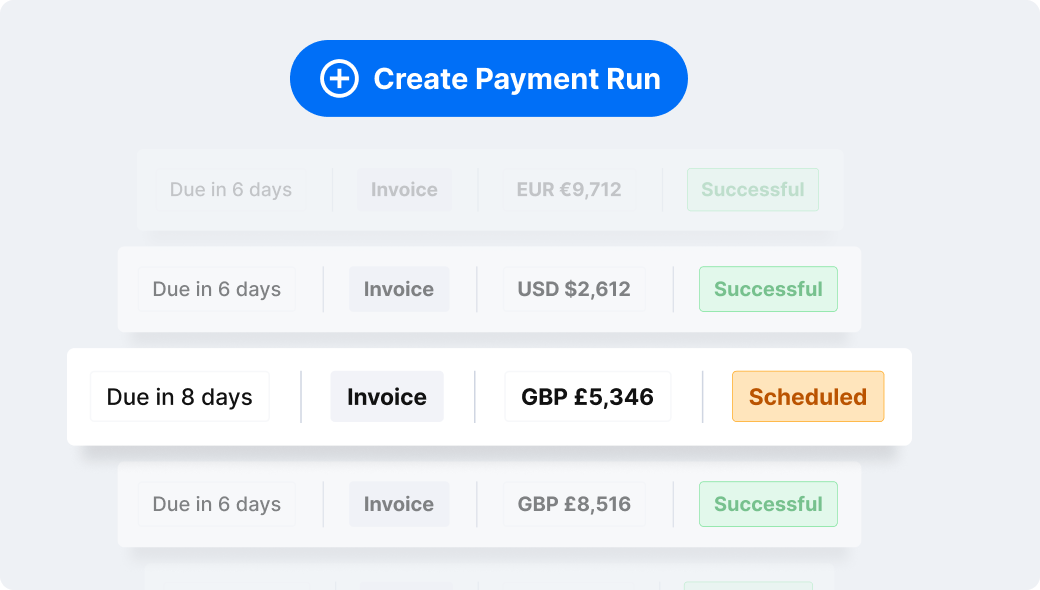

By automating invoice capture, approval workflows and payment execution, AP teams can reduce operational load while improving consistency and control. AI-powered data extraction, rule-based approvals and bulk payments eliminate repetitive tasks that don’t scale.

According to Modulr’s Fractional CFO Playbook, 46% of firms believe automation could free up more than three hours a week. We see this in practice across customers using automation across their finance stack.

As one customer explained:

“Modulr AP takes the legwork out of payables with our clients. What used to eat up hours now runs like clockwork. Everything’s automated, easy to track, and in one place - freeing us up to focus on our clients and the bigger advisory picture.”

Automation becomes critical as invoice volumes grow, supplier bases expand and teams are asked to do more with less.

Make 2026 the year your AP function scales - without scaling effort.

Tighten controls and reduce your risk

As AP operations scale, so does risk - unless controls are built in. Manual processes and fragmented systems make it harder to enforce separation of duties, manage access and maintain audit-ready records.

Fraud, duplicate payments and data errors are significantly more likely when access is poorly managed, or processes rely on manual checks. Strengthening controls starts with clear separation of duties, limited access to sensitive data and defined approval thresholds.

Modern payments automation platforms strengthen control by design. Rule-based approvals, permissioned access and real-time audit trails help reduce fraud, prevent duplicate payments and support compliance - without slowing teams down.

Practical steps to reduce AP risk include:

- Separating supplier setup from payment approval

- Restricting access to bank detail changes

- Using approval thresholds and audit-ready workflows

Clear controls don’t just protect the business. They give AP teams confidence to move faster, knowing payments are accurate and traceable.

Start 2026 with confidence - not crossed fingers.

Take control of your AP with Modulr →

Use instant payments to improve cash flow visibility

Cash flow decisions depend on timing, visibility and control. Traditional payment methods often require funds to be locked up days in advance, limiting flexibility when priorities shift.

Instant payments change that. With real-time payment execution and up-to-date balance visibility, AP teams can make confident decisions without compromising control - even under tight timelines.

Whether paying suppliers at short notice or managing payments for temporary staff, instant payments give teams the flexibility to respond in real time - without compromising control.

As reporting requirements evolve and expectations around payments increase, real-time money movement becomes a strategic advantage.

Cash flow decisions move faster in 2026 - your payments should too.

Kickstart your 2026

AP teams today are no longer just processing invoices. They’re safeguarding cash flow, strengthening supplier relationships and managing risk across the organisation.

With new payment practice reporting requirements expected in 2026, businesses will need to demonstrate not only how quickly they pay, but how consistently and transparently they do so. Nearly half of UK businesses still typically pay suppliers around 30 days after invoicing - reinforcing the need for better visibility and control.

By preparing now, finance teams can turn regulatory change into an opportunity to modernise AP and drive meaningful improvement.

Start 2026 with systems that work as hard as your AP team does.

How Modulr supports modern AP teams

Modulr is the payments automation platform built to scale.

From invoice capture through to payout, Modulr automates how money moves - delivering the efficiency, accuracy and reliability finance operations need as they grow. AP teams can automate approvals, execute bulk and scheduled payments, and gain real-time visibility – all directly integrated with their accounting software.

As we continue to build a global payments automation platform, Modulr helps businesses support growing supplier bases, higher invoice volumes and international payments - without increasing operational burden.

Thousands of businesses trust Modulr to run accurate, compliant supplier payments - because payments that scale need to be predictable, controlled and built on proven infrastructure.

Ready to take control of your payments?